Latest News

Protection Guru: Which income protection plans support clients returning to work?

17 Sep 2020

The core conversation when discussing income protection with clients will quite rightly focus on financial help provided if they are unable to work due to an accident or illness. But providers support clients in many ways beyond just the claim payment itself and one key focus is helping people become fit enough to get back into work through rehabilitation services and other support.

A client’s return to work is important and desirable for everyone concerned but needs to be handled properly to avoid any setbacks and many insurers will play a role in making sure it goes well, which can have a positive impact, not only for the client, but also the employer and the insurer. In this article we take a closer look at the way insurers liaise with employers and work with them to help reintegrate clients into the workplace.

Providers are keen to help people become fit enough again to return to work, and it’s a win, win, win situation. The client gains, as they can become independent quicker, the provider gets their employee back and the insurer gains as they can either pay a reduced benefit or stop benefits altogether. As well as discussions with employers in advance of a client’s return to work, in relation to what is needed to make the return run smoothly and how quickly the client can fully resume their duties, ongoing support can be offered to help people stay in work once they do return.

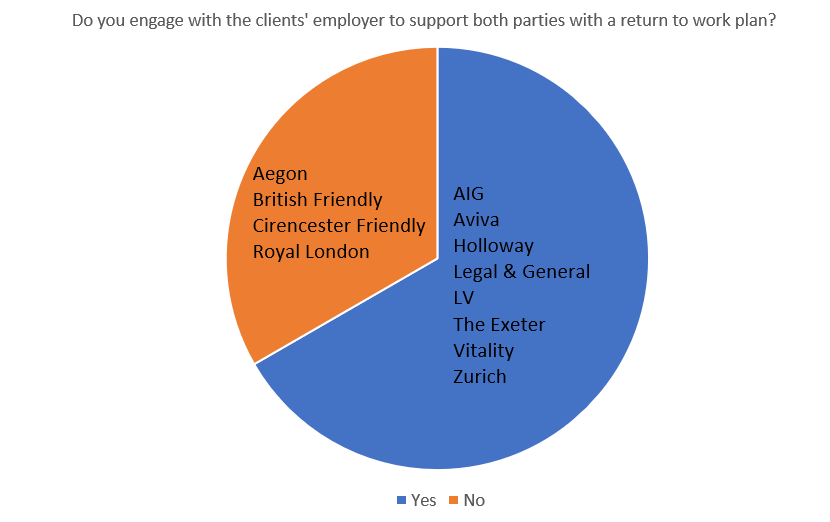

Our table shows which providers engage with the client’s employer to support both parties with a return to work plan. Looking at the circumstances in which those providing this service do this, all express their reasons in different ways but in broad terms, they will do so when it is seen as necessary.

VitalityLife’s response is perhaps the broadest, as it will engage with the employer when it is clear that a return to work is possible. The Exeter, Aviva and Legal & General’s approaches are very similar in that they emphasise individual circumstances and the need to engage employers if clients need help with their return to work.

Other insurers will engage with employers when there are specific reasons and a lack of occupational health services is something that AIG and Holloway Friendly both highlight. This is understandable as clients do not necessarily know what would make their working environment more comfortable, or what their employer can do to make their return easier. For example, someone who has had a back injury may not know the type of chair they need or how to adjust their existing chair to prevent further problems.

For LV= and Zurich, engaging with employers comes into play where the return to work needs to be gradual. LV= is the only provider that will offer support where there is an employer/employee dispute compounding the claim issues.

Sometimes insurers may turn to third parties to provide their return to work support services, while others will have the resources to keep it in-house. The table below illustrates when third party services are employed.

|

Provider

|

Third Party

|

|

AIG

|

Any third party necessary

|

|

Holloway Friendly

|

Vocational Specialists

|

|

LV=

|

Innovate Healthcare Group

|

|

The Exeter

|

Rehab Options

|

|

Vitality

|

Any third party necessary

|

|

Zurich

|

In-house rehabilitation team and Health Claims Bureau

|

The approach taken by AIG and VitalityLife is to work with whoever they need to, depending on the circumstances. Similarly, Holloway Friendly may involve a vocational specialist. At the opposite end of the spectrum, LV= works with workplace health and wellbeing specialist Innovate HealthCare Group. The Exeter also has a specific partner, Rehab Options, which creates rehabilitation/return-to-work programmes.

Zurich’s approach differs from other providers in that it has its own in-house rehabilitation team, but it can also draw a panel of external providers such as The Health Claims Bureau.

Looking in more detail at the return to work support that providers initially offer, all eight propositions provide the same kind of support that will help employers prepare for the client’s return to work. They all provide assistance in agreeing a date for the client to return to work, suitable working hours, a staged return plan together with support with changes that may need to be made to the working environment to accommodate the client’s return.

LV= stands out as it also provides help with vocational re-direction/transferable skills assessment, employer resolution if there is a dispute between the client and their employer, and help with medication.

Return to work support does not necessarily end when the client has gone back to work. There are two ways that providers offer further support once the client has returned

- Ongoing reviews of a client’s return to ensure that it is not damaging to their rehabilitation – after all, there is no point in rushing someone back to work to soon, only to find that they are taking on too much at that stage and are risking their long-term recovery.

- Ongoing dialogue with the employer to ensure that the return to work is going well and that the client has everything they need to do their job as well as they could pre-claim

Income protection is a plan that helps a client continue to support their family in the event that they are unable to work due to ill health. Providing the support to help that client back into work and therefore be independently able to support their family for many will be as, if not more, important than the financial assistance.

For customers who need to claim on income protection the financial relief will be immediate and obvious. But perhaps just as valuable is the support clients can receive to help them return to work and so be independently able to support their family. This sort of support is a great compliment to the industry and the providers who offer these services and should not be underestimated when looking to choose a suitable income protection solution